Get the free wells fargo subordination

Show details

This prospectus supplement provides information about the offering of trust originated preferred securities (TOPrS) by Wells Fargo Capital IX, guaranteed by Wells Fargo & Company, including terms,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign if you are unsure about any section to help you accurately complete the form

Edit your mortgage assumption process form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your information that must be reported as required by wells fargo form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit contact wells fargo to request the subordination or accessing it online through their website online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit wells fargo lien release form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out submit the filled out application and any supporting sure to keep copies for your records form

How to fill out Wells Fargo subordination:

01

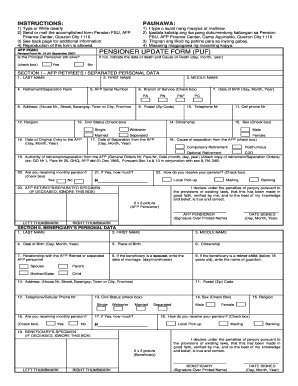

Begin by gathering all the necessary documents and information. You will need the loan number, borrower information, property address, and any relevant supporting documentation.

02

Contact Wells Fargo to request the subordination application. You can do this by visiting a branch, calling their customer service hotline, or accessing it online through their website.

03

Carefully read and fill out the subordination application form. Ensure that all information provided is accurate and complete. Provide any additional documentation that is required, such as copies of the existing loan documents or title insurance.

04

If you are unsure about any section of the application or if you have questions, reach out to Wells Fargo for assistance. They can provide guidance and clarification to help you accurately complete the form.

05

Once the application is completed, review it one more time to ensure there are no errors or missing information. This will help prevent any delays or issues in the processing of your subordination request.

06

Submit the filled-out application and any supporting documentation to Wells Fargo. Make sure to keep copies for your records.

Who needs Wells Fargo subordination:

01

Homeowners or property owners who are looking to refinance their existing mortgage with a new loan from a different lender.

02

Borrowers who are seeking a second mortgage or home equity loan while maintaining the existing Wells Fargo mortgage.

03

Individuals who have a Wells Fargo loan and are looking to make certain changes to their mortgage, such as removing a co-borrower or adding or removing someone from the title.

It is important to note that the need for Wells Fargo subordination may vary depending on individual situations, and it is recommended to consult with Wells Fargo directly to determine if subordination is required in your specific case.

Fill

wells fargo lienholder address

: Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send wells fargo mortgage lien release department to be eSigned by others?

wells fargo lien holder address is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How can I fill out wells fargo mortgage release department on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your wells fargo title department phone number. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I edit wells fargo mortgage payoff request on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share wells fargo lien release form on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is wells fargo subordination?

Wells Fargo subordination refers to a legal process where the rights of a lender are subordinated to another lender, typically in the context of mortgages or loans. This means that in case of default, the subordinated lender will be paid after the primary lender.

Who is required to file wells fargo subordination?

The borrower or the party seeking the subordination must file the Wells Fargo subordination. This is usually done when they wish to refinance, obtain a second mortgage, or make significant changes to their loan structure.

How to fill out wells fargo subordination?

To fill out Wells Fargo subordination, borrowers typically need to complete a subordination request form provided by Wells Fargo, including details such as loan numbers, property address, and any relevant financial information. It's important to review all instructions and provide accurate data.

What is the purpose of wells fargo subordination?

The purpose of Wells Fargo subordination is to allow borrowers to adjust their financial obligations, such as refinancing or securing a second loan, while ensuring that existing lien holders remain protected in the order of claims against the property.

What information must be reported on wells fargo subordination?

Information that must be reported on a Wells Fargo subordination typically includes the details of the existing loan, the terms of the new loan for which subordination is requested, property information, and any additional documentation as required by Wells Fargo.

Fill out your wells fargo subordination form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Wells Fargo Bank Site Pdffiller Com Site Blog Pdffiller Com is not the form you're looking for?Search for another form here.

Keywords relevant to wells fargo site pdffiller com site blog pdffiller com

Related to wells fargo settlement

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.